Managing income and deductions can be challenging, especially if you’re juggling multiple jobs, gigs, or freelance projects. This is where a check stub maker becomes a vital tool. It helps you organize financial details, track payments, and stay on top of deductions such as taxes, insurance, and benefits. Whether you’re a salaried employee, freelancer, or business owner, using a check stub maker can simplify your financial management.

Here’s a comprehensive look at how a check stub maker can help you take control of your income and deductions.

What Are Check Stubs?

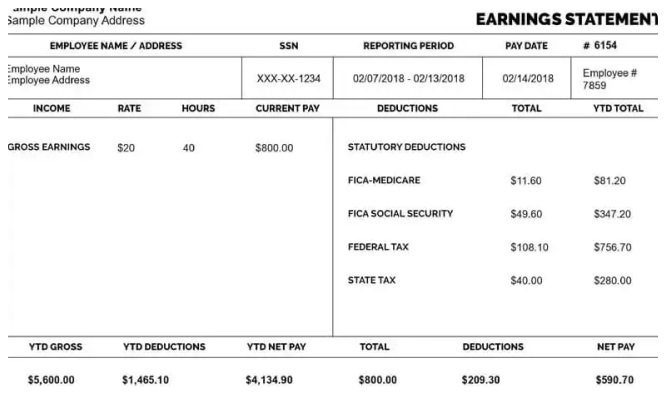

Check stubs, also known as pay stubs, are detailed records of an employee’s earnings and deductions. They include important financial information such as:

- Gross income (total earnings before deductions).

- Taxes withheld (e.g., federal, state, and local taxes).

- Benefits deductions (e.g., health insurance or retirement contributions).

- Net income (the amount you take home).

For freelancers or business owners, a check stub helps to document income and track deductions for tax filing and budgeting purposes.

Why Is a Check Stub Maker Important?

1. Keeps Financial Records Organized

With a check stub maker, you can generate detailed records for every payment. These records help you monitor your income streams and ensure accurate reporting during tax season.

2. Simplifies Tax Preparation

Knowing exactly how much income you earned and what deductions were taken out makes tax preparation easier. If you’re self-employed, having clear documentation of earnings and deductions is crucial for filing taxes correctly and avoiding penalties.

3. Ensures Transparency

If you employ workers or contractors, providing them with check stubs through a check stub maker promotes transparency and professionalism. Employees appreciate seeing a clear breakdown of how their wages are calculated.

4. Tracks Deductions Efficiently

Deductions can add up quickly, and it’s easy to lose track of them without proper documentation. A check stub maker itemizes all deductions, so you always know where your money is going.

Who Can Benefit from a Check Stub Maker?

1. Freelancers and Gig Workers

If you work on a project-to-project basis, keeping track of payments can be overwhelming. A check stub maker helps you document each payment and its corresponding deductions, which is especially helpful when filing self-employment taxes.

2. Small Business Owners

As a business owner, generating check stubs for employees is a legal and ethical necessity. A check stub maker streamlines this process, ensuring accuracy and saving time.

3. Shift Workers

Employees in industries like retail and hospitality often have fluctuating hours. A check stub maker can reflect these changes and help workers understand their pay structure, including overtime and tips.

4. Contractors and Consultants

Independent contractors often manage multiple clients simultaneously. Using a check stub maker ensures they have clear records of earnings and deductions, making invoicing and tax filing easier.

Key Features of a Good Check Stub Maker

1. Customization

A good check stub maker allows you to customize fields such as gross income, deductions, and company information.

2. Accuracy

Accurate calculations are essential for both employees and employers. The best check stub makers automatically compute taxes and deductions based on the information provided.

3. Accessibility

Look for a check stub maker that’s easy to use and accessible online, allowing you to create stubs from anywhere.

4. Multiple Templates

Having various templates to choose from ensures that the check stubs meet your needs, whether for personal use, business purposes, or freelance work.

How to Use a Check Stub Maker

Step 1: Enter Basic Information

Input the necessary details, including your name, employer’s name, pay period, and payment date.

Step 2: Add Earnings and Deductions

List your gross earnings, taxes, benefits, and other deductions. Ensure these figures are accurate to avoid discrepancies.

Step 3: Generate and Save

Once all fields are filled, generate your check stub and save it in a secure location. Most tools allow you to download stubs in PDF format for easy access and sharing.

Tips for Organizing Income and Deductions

1. Use Separate Accounts

If possible, use separate bank accounts for personal and business finances. This simplifies tracking income and deductions.

2. Automate Where Possible

Automate deductions like taxes and savings contributions to ensure you never miss a payment.

3. Review Regularly

Periodically review your check stubs to ensure all deductions are accurate and consistent. This helps you identify discrepancies early.

4. Stay Updated on Tax Laws

Tax regulations change frequently. Stay informed to ensure your deductions align with current laws and maximize your tax benefits.

Common Deductions to Watch For

1. Taxes

Federal, state, and local taxes are typically the largest deductions from your paycheck.

2. Social Security and Medicare

These mandatory contributions support the Social Security and Medicare systems.

3. Retirement Contributions

If you contribute to a 401(k) or similar plan, these amounts are deducted from your paycheck.

4. Insurance Premiums

Deductions for health, dental, or vision insurance often appear on check stubs.

The Benefits of Staying Organized

When you use a check stub maker to organize your income and deductions, you enjoy several benefits:

- Financial Clarity: Know exactly where your money is coming from and going.

- Improved Budgeting: Detailed records make it easier to create and stick to a budget.

- Stress-Free Tax Filing: With accurate documentation, filing taxes becomes less stressful and more straightforward.

- Professionalism: Providing check stubs demonstrates professionalism and builds trust with employees or clients.

Final Thoughts

A free check stub maker is a valuable tool for anyone looking to manage their income and deductions efficiently. From freelancers and small business owners to shift workers and independent contractors, this tool helps streamline financial processes and provides clarity.

By generating detailed and accurate check stubs, you can stay organized, plan better for the future, and avoid potential financial pitfalls. Whether you’re preparing for tax season, managing employee payroll, or simply tracking your earnings, a check stub maker simplifies the process and gives you peace of mind.

Start using a check stub maker today and take control of your financial records.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary