Taking on debt to buy a car ties up your money for years. Car loans usually drag on between 3 to 6 years. And the longer they last, the more interest you pay to the lender. Paying your car off quicker puts cash back in your pocket faster by decreasing how much interest you pay overall.

To afford those higher monthly payments, you’ll likely need to cut expenses elsewhere. Pack your lunch instead of eating out. See if you can downgrade your phone or cable plan. Review spending on groceries and fun – where can you tighten to funnel savings toward your car loan? It all adds up when trying to pay a loan faster.

If you got stuck with a high interest rate, look into car finance in Ireland. This lets you swap your current terms for a better rate and potentially good savings over the loan. Make sure to compare rates from many lenders for the best deal. Credit unions tend to have competitive refinancing rates.

Understand Your Loan Terms

Many personal loans allow you to pay off the balance early without penalties. Check if your loan contract includes prepayment penalties before putting down extra money.

How Extra Payments Impact Loan Balance

Making payments above the monthly minimum goes straight to reducing your principal loan amount owed. This pays off the balance faster and lowers total interest fees over the loan’s duration. Ask lenders how soon extra payments show up on your balance.

Know Interest Charges Versus Principal

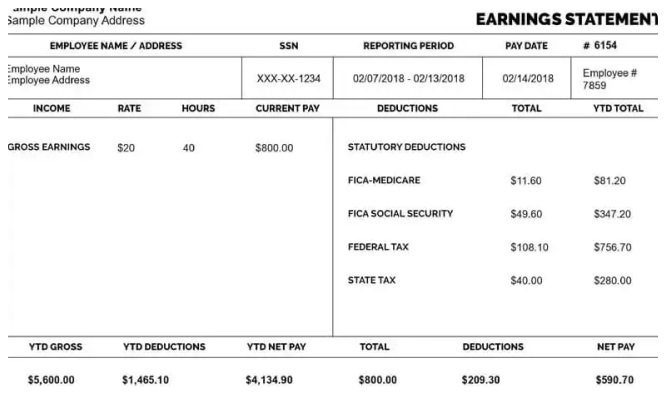

Loan statements break down how much of your monthly payment goes toward interest fees versus the actual loan principal. The interest portion is usually highest at the start and declines over time as the principal drops. Track how extra payments reduce interest fees.

Keep watching for notices about adjustments to loan charges, rates, or terms after originating the loan. Read any updates from your lender explaining changes and what they mean for your balance and payments going forward. Don’t ignore important notifications that could impact finances.

Create a Budget for Extra Payments

Look at your regular spending every month. See where you can cut back to save some extra pounds for your loan. Lower costs on things you don’t really need. Use that money to pay more on your loan. It will help pay off the loan faster.

Find Monthly Savings

Write down all your normal costs. Rent, food, entertainment, etc. See what you can reduce or go without. Even small monthly savings of £10 or £20 can make a difference. Use a budget app to help track spending cuts.

Cut Unneeded Spending

Stop going out to eat as often. Bring your lunch to work. Cancel unused subscriptions. Trim grocery or electricity costs. Small daily savings lead to bigger extra principal payments.

Use any sporadic income like bonuses, tax refunds, or gift money to make lump sum payments on your car loan principal. Retiring other debt also frees up cash flow for your auto loan.

Make Bi-Weekly Payments

Most car loans are structured for one payment per month. Make half payments every two weeks instead. You end up making 26 half-payments annually. This equals one whole extra monthly payment per year.

Pay Loan Twice Per Month

Contact your lender to set up automatic payments to come out every other week. Or manually make the half-payments yourself through online banking. This bi-weekly structure pays extra toward the principal every year.

Saves Money Long-Term

That extra payment helps chip away at what you owe each year. You pay off the balance faster and reduce total interest fees over the loan’s duration. Even an extra £20 or £50 monthly makes a big difference in the long run.

Paying more than required saves money and shortens loan length. Make cuts elsewhere to put extra funds toward your auto loan principal.

Round Up Your Payments

Look at the amount due on your monthly loan payment. Round the payment up to the next £50 or £100. The extra money goes directly toward your loan principal.

Round to Nearest £50

If your payment is £215 per month, round up to £250 instead. An extra £35 goes to the principal. Or if your payment is £172, round up to £200. That’s £28 more toward your balance.

Round to Next £100

For larger payments, go up to the next £100 mark. A £412 monthly payment gets rounded up to £500. The extra £88 goes straight to paying down what you owe.

Small Round Ups Add Up

An extra £20 – £100 per month may not seem like much. But over the course of a 2-5-year loan term, those small additions slice away at your principal. This speeds up how fast the loan gets paid off.

Rounding payments only require small spending adjustments on your end. You don’t need large sacrifices or major lifestyle changes. However, small changes generate outsized financial benefits in the long run.

Poor Credit History Hurts Finances

Having very low credit scores under 620 considered poor credit. Late payments, collections, judgments and bankruptcies drag scores down. Poor credit history makes getting approved for loans and credit extremely difficult.

It limits financing options to rebuild credit. But specialized lenders offer bad credit loans to those with less-than-perfect credit.

How Bad Credit Loans Work

These personal loans are designed specifically for bad credit borrowers. Lenders take on more risk lending to customers with low credit scores. So bad credit loans charge higher interest rates and fees compared to traditional bank lending products.

Finding Reputable Bad Credit Lenders

With interest rates and fees much higher than regular loans, finding trustworthy lenders is critical. Research lender reputations thoroughly before applying for any bad credit personal loan. Read reviews and complaints before submitting applications.

Responsible loans help create a positive payment history to rebuild credit step-by-step over time. Check credentials with groups like Better Business Bureau.

Conclusion

Making extra payments directly toward your car loan principal speeds up repayment. You pay less total interest with a faster paydown of what you owe.

If equity allows, consider refinancing what remains into a shorter 12-24-month instalment loan. This pushes payoff faster with a trade-off of higher monthly payments. Make sure to compare rates and run calculations on total savings first. Enjoy driving your fully owned vehicle payment-free sooner when an early payoff becomes your priority now.