Freelancing offers freedom, flexibility, and the ability to work on exciting projects, but it also comes with its own set of challenges. As a freelancer, you’re not just the creator—you’re also the business owner, manager, and accountant. One of the biggest hurdles is managing your income and taxes. Unlike traditional employees who receive paychecks and tax withholdings, freelancers are responsible for tracking their earnings and making sure they set aside the right amount for taxes.

This is where a free paycheck creator or free paycheck stub creator can make your life much easier. These online tools help you manage your income, track payments, and stay on top of your taxes, all without the need for expensive software or an accountant.

In this blog, we’ll walk you through how to use these paycheck creation tools to simplify your financial life as a freelancer. We’ll cover how they can help with income tracking, tax preparation, professional invoicing, and more.

What is a Free Paycheck Creator?

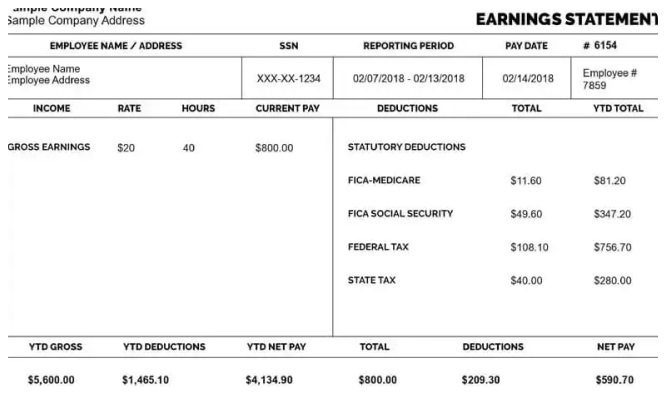

A free paycheck creator or paycheck stub creator is an online tool that allows freelancers (and employees) to generate pay stubs or paychecks without paying for expensive software. It’s a simple and efficient way to create documents that break down your earnings, taxes, and deductions in a professional, easy-to-read format.

These tools typically offer a range of features, such as customizable templates, automatic tax calculations, and options to add deductions like healthcare, retirement savings, or business expenses. Using a free paycheck stub creator can help you maintain accurate records and stay on top of your finances.

Now that you know what these tools are, let’s dive into how you can use them to manage your income and taxes as a freelancer.

1. Track Your Income Easily

One of the biggest challenges freelancers face is keeping track of their income. Since you likely have multiple clients with different payment schedules and rates, it can be difficult to stay organized. A free paycheck creator simplifies this process by allowing you to input payment details and generate pay stubs that clearly show how much you’ve earned, when you earned it, and who paid you.

For example, when you get paid for a project, you can create a paycheck stub that shows:

- The amount paid by the client

- The project or services provided

- Payment date

- Any applicable deductions (like business expenses or taxes)

By creating a paycheck stub for every payment you receive, you’ll have a detailed record of your income. This makes it easy to track your earnings over time and identify any gaps in payment.

2. Stay Tax-Ready

As a freelancer, you’re responsible for your own taxes, which means you need to keep accurate records of your earnings and deductions. A free paycheck stub creator helps you stay tax-ready by automatically calculating your tax deductions, including federal, state, and local taxes. Some tools also allow you to input your tax rate, helping you estimate how much you should set aside for taxes.

For example, if you’re a freelancer in the United States, you’re generally required to pay self-employment tax in addition to federal income tax. This can be a bit complicated to calculate on your own, but a paycheck creator tool can help you determine the proper amounts based on your income.

In addition, many paycheck creators offer options to include other deductions, such as retirement contributions or health insurance premiums, which are often deductible expenses for freelancers. Keeping track of these deductions can reduce your taxable income and lower the amount you owe come tax time.

3. Create Professional Pay Stubs for Clients

As a freelancer, you want to maintain a professional image with your clients. Sending a detailed, organized paycheck stub after every payment helps demonstrate your professionalism. A free paycheck creator can generate clear and accurate pay stubs that outline the services you provided and the payment you received.

When you use a paycheck stub creator, your clients will have a better understanding of the work you’ve completed, the agreed-upon rate, and the payment breakdown. This transparency fosters trust and can help build long-term client relationships.

For example, if a client hires you for a large project, you can provide them with a pay stub after each milestone is completed, showing the total payment and any applicable taxes or deductions. This not only looks professional but also ensures that both parties are clear on the payment terms.

4. Easily Customize Pay Stubs for Different Clients

Freelancers often work with multiple clients, each with their own payment terms and rates. A free paycheck stub creator makes it easy to customize pay stubs for each client. You can add details like the client’s name, the project description, and the payment terms.

Many paycheck stub creators also allow you to customize the appearance of the pay stubs, so you can add your logo, business name, and contact information. This customization helps you maintain a consistent brand image across all your client communications.

Whether you’re charging hourly rates, flat fees, or project-based payments, a paycheck creator tool lets you easily adjust the pay stub format to reflect your unique payment structure.

5. Manage Multiple Payment Methods

As a freelancer, you might receive payments in various forms—PayPal, bank transfers, checks, or even cash. A free paycheck creator allows you to record each of these payments accurately. By adding payment methods to your paycheck stubs, you create a clear and comprehensive record of how you were paid.

For example, if you receive part of a payment via PayPal and the rest via check, you can generate a pay stub that shows both payment methods, along with the corresponding amounts. This will make it easier to track your income and prevent errors when it comes time to calculate your total earnings.

6. Stay Organized for Tax Season

Freelancers don’t get tax withholdings taken out of their payments, so it’s crucial to keep detailed records of your income and expenses throughout the year. Using a free paycheck stub creator is an excellent way to stay organized. Every time you generate a paycheck stub, you create an official record of your earnings, making it easier to calculate your total income for the year.

When tax season rolls around, you’ll have all your paycheck stubs organized in one place. This will help you quickly calculate how much income you need to report to the IRS and identify any deductions you may qualify for. Additionally, the breakdown of your pay stubs will make it easier to fill out your Schedule C (Profit or Loss From Business) and Schedule SE (Self-Employment Tax) forms.

7. Track Business Expenses and Deductions

Freelancers are eligible to deduct certain business expenses, such as home office costs, equipment, and software subscriptions. Many free paycheck creators allow you to input additional deductions, such as business expenses or retirement savings contributions, which can help reduce your taxable income.

By tracking these expenses throughout the year, you’ll be in a better position to lower your tax liability. For instance, if you purchase a new laptop for your freelance work, you can deduct the cost of the laptop when filing your taxes. Your paycheck stub can be a useful tool for organizing these deductions and keeping track of the expenses related to your business.

8. Stay Compliant With State and Local Tax Laws

Different states and local governments have different tax laws, so it’s important to ensure you’re in compliance with all relevant regulations. A free paycheck stub creator can help you by including the necessary fields for state and local tax deductions. By using these tools, you can ensure that you’re properly withholding the right amount of taxes based on your location.

Some paycheck creators even allow you to input your state and local tax rates, making it easier to calculate the correct deductions. If you work with clients in multiple states or cities, this feature can be invaluable in ensuring that you’re meeting all the tax obligations in each jurisdiction.

9. Reduce Human Error

Tracking income, calculating taxes, and creating pay stubs manually can lead to mistakes, especially when you’re managing everything on your own. A free paycheck stub creator reduces the chances of errors by automating calculations. These tools take care of the math for you, ensuring that your pay stubs are accurate every time.

By relying on a paycheck creator, you’ll reduce the risk of underreporting your income or overestimating your tax deductions, both of which can lead to costly mistakes. This automation gives you peace of mind and lets you focus on your work instead of worrying about bookkeeping errors.

10. It’s Free and Easy to Use

One of the best things about using a free paycheck creator is that it’s, well, free! Many tools offer their basic features at no cost, meaning you don’t have to invest in expensive software or hire an accountant to manage your finances. All you need is an internet connection, and you can start creating pay stubs in minutes.

Most tools are simple to use, even for freelancers who don’t have a background in accounting or finance. The user-friendly interfaces make it easy to enter your income details and generate professional pay stubs without any complicated steps.

Conclusion

Managing income and taxes is one of the trickiest parts of freelancing, but with the help of a free paycheck stub creator, you can streamline the process. These tools help you track your income, stay tax-ready, maintain professionalism with clients, and keep accurate records—all without breaking the bank.

By using a paycheck creator, you can focus on doing what you love—whether it’s writing, designing, programming, or consulting—while leaving the financial details to the tool. Whether you’re a seasoned freelancer or just getting started, these free tools can save you time, reduce stress, and help you stay on top of your financial responsibilities.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs