In today’s business landscape, generating paystubs for employees is a crucial task for maintaining transparency and compliance in payroll processes. Paystubs not only serve as proof of income but also provide detailed insights into earnings and deductions, making them essential for employees and employers alike. This guide will walk you through how to generate paystubs for employees effectively, including the use of a free paystub generator.

What is a Paystub?

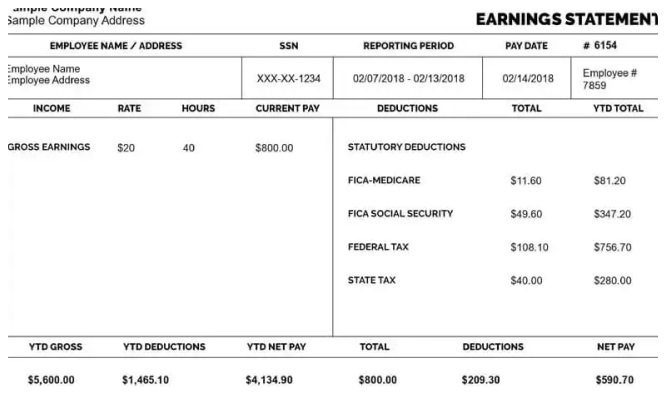

A paystub, also known as a pay slip or paycheck stub, is a document that outlines an employee’s earnings and deductions for a specific pay period. It typically includes important information such as gross pay, net pay, and various deductions. Paystubs serve multiple purposes, including:

- Proof of Income: Needed for loans, rental applications, and other financial matters.

- Tax Documentation: Useful for preparing and filing tax returns.

- Financial Planning: Helps employees understand their earnings and manage their finances.

Importance of Generating Accurate Paystubs

Generating accurate paystubs is crucial for several reasons:

- Legal Compliance: Many jurisdictions require employers to provide paystubs to employees.

- Employee Satisfaction: Transparent paystubs foster trust and understanding between employers and employees.

- Financial Clarity: Paystubs help employees track their earnings and deductions, assisting them in budgeting and financial planning.

Essential Information on Paystubs

Before you begin generating paystubs, it’s essential to understand what information needs to be included. A well-structured paystub should contain the following details:

1. Employer Information

- Company Name: The official name of the business.

- Company Address: The physical location of the business.

- Tax Identification Number (TIN): This may be required for tax reporting purposes.

2. Employee Information

- Employee Name: Full name of the employee receiving the paystub.

- Employee Address: Current address of the employee.

- Employee ID or Social Security Number: A unique identifier for the employee.

3. Pay Period Details

- Start Date: The beginning date of the pay period.

- End Date: The concluding date of the pay period.

- Payment Date: The date on which the payment is issued.

4. Earnings Information

- Gross Pay: Total earnings before any deductions, including regular wages, overtime, and bonuses.

- Hourly Rate: For hourly employees, include the hourly wage and total hours worked.

- Salary Amount: For salaried employees, indicate the salary amount for the pay period.

5. Deductions

- Federal Income Tax: Amount withheld for federal taxes.

- State Income Tax: Amount withheld for state taxes.

- Social Security Tax: Amount withheld for Social Security.

- Medicare Tax: Amount withheld for Medicare.

- Health Insurance Premiums: Deductions for health insurance.

- Retirement Contributions: Amounts deducted for retirement plans, such as a 401(k).

6. Net Pay

- Net Pay: The amount the employee takes home after all deductions.

7. Year-to-Date (YTD) Information

- YTD Totals: Running totals of earnings and deductions for the year.

8. Additional Information

- Leave Balances: Current balances for vacation, sick leave, or personal days.

- Employer Contributions: Any amounts the employer contributes to retirement plans or health benefits.

Steps to Generate Paystubs for Employees

Generating paystubs for employees can be done manually or through automated systems. Here’s a step-by-step guide on how to do it effectively:

Step 1: Gather Necessary Information

Collect all the required information for each employee, including their personal details, pay rates, hours worked, and any deductions applicable.

Step 2: Calculate Earnings and Deductions

Before generating a paystub, calculate each employee’s earnings and deductions:

- Gross Pay Calculation: Sum up regular hours, overtime, and any bonuses or commissions.

For example:

- Regular Hours: 40 hours at $25/hour = $1,000

- Overtime (1.5x): 10 hours at $37.50/hour = $375

- Total Gross Pay = $1,000 + $375 = $1,375

- Deductions Calculation: Use current tax rates and any other relevant figures to determine total deductions.

For example:

- Federal Tax (15%): $1,375 x 0.15 = $206.25

- State Tax (5%): $1,375 x 0.05 = $68.75

- Health Insurance: $150

Total Deductions = $206.25 + $68.75 + $150 = $425

- Net Pay Calculation: Net Pay=Gross Pay−Total Deductions\text{Net Pay} = \text{Gross Pay} – \text{Total Deductions} Net Pay=$1,375−$425=$950\text{Net Pay} = \$1,375 – \$425 = \$950

Step 3: Choose a Paystub Format

You can generate paystubs in various formats:

- Spreadsheet Software: Microsoft Excel or Google Sheets allows for customizable paystub templates.

- Word Processing Software: Microsoft Word or Google Docs can be used for simpler layouts.

- Online Templates: Look for free online templates that you can customize.

Step 4: Design the Paystub

When designing your paystub, ensure it is clear and professional. Organize the information effectively using headings and sections. A typical layout might include:

- Header: Employer name and logo.

- Employee Information: Clearly label the employee’s name and address.

- Pay Period Details: List the pay period and payment date.

- Earnings Section: Break down earnings, including gross pay and any bonuses.

- Deductions Section: List all deductions clearly.

- Net Pay: Clearly display the net pay.

Step 5: Review the Paystub

Before finalizing, review the paystub for accuracy. Make sure all information is correct and clearly presented. Double-check calculations to avoid any errors.

Step 6: Save and Distribute

Once you’re satisfied with the paystub, save it in a secure format, such as PDF, to prevent unauthorized edits. You can then distribute it to the employee, either digitally or physically.

Using a Free Paystub Generator

If the manual process seems overwhelming, using a free paystub generator can simplify the task. These online tools are designed to create professional paystubs quickly and efficiently.

Benefits of Using a Free Paystub Generator

- Ease of Use: Most generators are user-friendly and require minimal input.

- Professional Templates: They provide polished templates that enhance the credibility of your paystubs.

- Customizable Fields: You can easily enter specific employee information and earnings details.

- Cost-Effective: Many paystub generators are free, making them accessible to businesses of all sizes.

How to Use a Free Paystub Generator

Here’s a quick guide on how to use a free paystub generator:

- Select a Reliable Generator: Research various options and choose one with good reviews and security features.

- Input Employee Information: Fill in the required fields for the employee, including their name, address, pay period, gross pay, and deductions.

- Generate the Paystub: Once all information is entered, click to generate the paystub.

- Review and Download: Check the generated paystub for accuracy and download it for your records.

Common Mistakes to Avoid

When generating paystubs, be aware of these common pitfalls:

- Inaccurate Calculations: Always double-check math to ensure earnings and deductions are correct.

- Missing Information: Ensure all required information is included to avoid confusion.

- Poor Formatting: A cluttered or unprofessional appearance can undermine the legitimacy of the paystub.

Conclusion

Generating paystubs for employees is a vital responsibility that enhances transparency and trust in the employer-employee relationship. By including all necessary information—such as employer and employee details, earnings, deductions, and net pay—you can create professional and compliant paystubs.

If you find the process daunting, consider using a free paystub generator to streamline your workflow. With the right tools and a clear understanding of the requirements, you can effectively manage payroll documentation and contribute to your employees’ financial well-being. By following the steps outlined in this guide, you’ll be well-equipped to generate accurate and professional paystubs with confidence.