Managing payroll is one of the most critical aspects of running a business. Ensuring employees are paid accurately and on time, while complying with tax laws and regulations, can be both time-consuming and complex. Payroll software offers a streamlined, automated solution that not only reduces the risk of errors but also improves efficiency and compliance. However, with a wide range of payroll software available on the market, choosing the right one for your business can be overwhelming.

This guide will walk you through the essential factors to consider when selecting payroll software, the types available, and how to ensure that the solution you choose fits your business needs.

Why Payroll Software is Essential for Your Business

1. Accuracy and Compliance

One of the key benefits of payroll software is that it significantly reduces the chances of human errors in calculations, which can result in underpayments, overpayments, or issues with tax filing. Many payroll platforms are equipped with features that ensure compliance with tax laws, including automatic updates for tax rates and regulations.

2. Time Savings

Payroll software automates many tasks that would otherwise take considerable time to manage manually. From calculating wages and deductions to generating pay stubs and reports, these platforms help free up valuable time for HR and payroll teams to focus on other business priorities.

3. Cost-Effectiveness

While some businesses may be hesitant about the cost of payroll software, it’s important to weigh this against the savings in time, reduced errors, and potential fines for non-compliance. Small businesses, in particular, can benefit from cost-effective solutions that scale as they grow.

4. Improved Employee Experience

Many payroll systems offer self-service portals where employees can access their pay stubs, tax forms, and benefits information. This level of transparency not only empowers employees but also reduces the administrative burden on HR staff.

Types of Payroll Software

Before diving into the selection process, it’s important to understand the different types of payroll software available. Each type offers different features and is suited for businesses of varying sizes and needs.

1. On-Premise Payroll Software

On-premise payroll software is installed directly on the company’s computers or servers. This option gives businesses full control over their data and software, which may be important for those with specific data security concerns. However, it may require significant IT support for maintenance, updates, and data security measures.

2. Cloud-Based Payroll Software

Cloud-based payroll software is hosted on remote servers and accessed via the internet. This type of software is ideal for businesses looking for flexibility, as it allows users to manage payroll from anywhere with an internet connection. Cloud-based solutions often offer automatic updates, data backups, and integration with other cloud-based tools.

3. Payroll Services

Some businesses choose to outsource their payroll to a third-party payroll service provider. These providers handle all aspects of payroll management, from processing payments to filing taxes. While this option can relieve businesses of the burden of managing payroll in-house, it can be more costly and may offer less control over the payroll process.

4. Industry-Specific Payroll Software

Certain industries, such as construction, healthcare, or education, have specific payroll needs that general-purpose software may not address. Industry-specific payroll software is designed with these unique requirements in mind and can help ensure compliance with industry regulations.

Key Features to Look for in Payroll Software

When evaluating payroll software, it’s important to consider the features that will be most beneficial for your business. Below are some of the most important features to keep in mind:

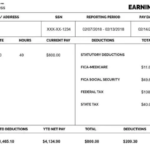

1. Automatic Tax Calculation and Filing

One of the most critical features of payroll software is its ability to calculate and file taxes automatically. This includes not only federal taxes but also state and local taxes, which can vary depending on the location of your business and employees. Software with built-in tax compliance features can help ensure that you are meeting all regulatory requirements and avoid costly penalties.

2. Direct Deposit and Payment Options

Offering employees a variety of payment options, including direct deposit, paper checks, and prepaid debit cards, can improve their experience and streamline the payroll process. Most payroll software offers direct deposit as a standard feature, but it’s important to verify what payment options are available and whether there are additional fees for certain methods.

3. Employee Self-Service Portals

An employee self-service portal allows workers to access their pay information, tax documents, and personal details without having to go through HR. This not only saves time for your HR team but also empowers employees to manage their own information.

4. Time Tracking Integration

If your business uses time tracking software to monitor employee hours, it’s important to choose payroll software that integrates seamlessly with your time tracking system. This ensures that employees are paid accurately based on their hours worked, whether they are hourly or salaried.

5. Customizable Pay Schedules

Depending on your workforce, you may need to run payroll on different schedules. For example, some employees may be paid weekly, while others are paid monthly. Look for payroll software that allows for customizable pay schedules to accommodate different employee groups.

6. Benefits Management

Many payroll platforms include features for managing employee benefits, such as health insurance, retirement plans, and paid time off (PTO). Integrating benefits management with payroll can help reduce errors and ensure that deductions are accurately reflected in employee paychecks.

7. Mobile Access

For businesses with remote or on-the-go workers, mobile access to payroll software can be a huge advantage. Mobile apps or web-based access allows managers and employees to view and manage payroll information from their smartphones or tablets.

8. Reporting and Analytics

Having access to detailed reports and analytics can help you make informed decisions about your payroll, labor costs, and employee compensation. Look for software that offers customizable reporting options, such as payroll summaries, tax liability reports, and employee earnings.

Factors to Consider When Choosing Payroll Software

With so many options available, it’s important to carefully evaluate your business needs before selecting payroll software. Below are some factors to consider during the decision-making process:

1. Business Size and Growth

Your company’s size will have a significant impact on the type of payroll software that’s best for you. Small businesses may not need the same level of functionality as larger companies, so it’s important to choose a solution that fits your current needs but can also scale as your business grows.

2. Budget

Payroll software comes in a variety of price points, from basic solutions for small businesses to more comprehensive platforms for large enterprises. It’s important to balance the cost of the software with the features and support it provides. Be sure to factor in any additional costs, such as fees for direct deposit or tax filing services.

3. Ease of Use

Even the most feature-rich software will be of little value if it’s too difficult to use. Look for software with an intuitive interface that can be easily navigated by your HR and payroll teams. Many providers offer free trials or demos, which can give you a sense of the user experience before committing to a purchase.

4. Integration with Existing Systems

If your business already uses other software, such as accounting, time tracking, or human resources management systems, it’s important to choose payroll software that integrates seamlessly with these platforms. This can help streamline your processes and avoid duplicating data entry.

5. Customer Support

Reliable customer support is crucial when it comes to payroll software, especially if you encounter technical issues or need help with compliance. Be sure to check what types of customer support are available, whether it’s phone, email, live chat, or an online knowledge base. Also, consider the provider’s reputation for responsiveness and the quality of their support.

6. Security

Payroll data includes sensitive information such as employee Social Security numbers, bank account details, and tax information. Therefore, it’s essential to choose software that provides robust security features, such as encryption, user access controls, and regular data backups.

7. Compliance with Local Regulations

Different countries and regions have unique payroll and tax regulations, so it’s important to choose software that complies with the laws applicable to your business. Some platforms offer multi-country support, which can be especially useful for businesses with international employees.

Popular Payroll Software Solutions

Here are a few popular payroll software options that cater to a range of business sizes and needs:

- Gusto: A user-friendly, cloud-based platform with features for payroll, benefits administration, and HR management.

- QuickBooks Payroll: Ideal for small to medium-sized businesses, this software integrates seamlessly with QuickBooks accounting software.

- ADP: A comprehensive payroll and HR solution that offers robust features for larger businesses, including global payroll support.

- Paychex: A flexible payroll platform that offers solutions for businesses of all sizes, along with time tracking and benefits management tools.

Conclusion

Choosing the right payroll software for your business is a critical decision that can have a lasting impact on your company’s efficiency, compliance, and employee satisfaction. By understanding your business needs, evaluating key features, and considering factors like budget, ease of use, and scalability, you can select a payroll solution that not only meets your current requirements but also grows with your business.

With the right payroll software in place, you can ensure that your payroll processes are accurate, efficient, and compliant, giving you more time to focus on other aspects of running your business.