Managing payroll is a crucial responsibility for small business owners, freelancers, and self-employed professionals. A payroll check generator is a convenient tool that simplifies the process of creating paychecks for employees and contractors. However, many business owners wonder whether using a payroll check generator is legal.

In this guide, we’ll explore the legality of payroll check generators, how they work, and how to use them responsibly to stay compliant with laws and regulations.

What Is a Payroll Check Generator?

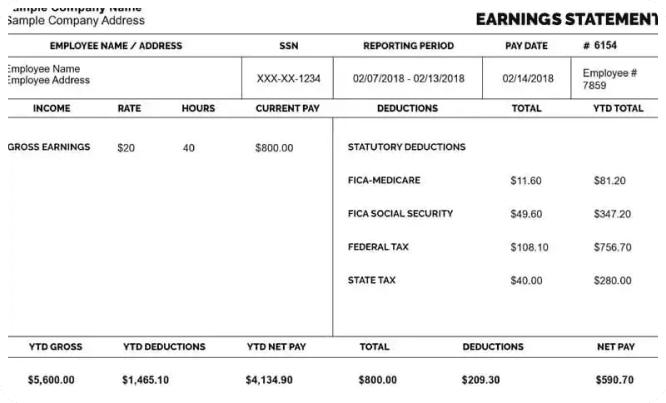

A payroll check generator is an online tool that helps businesses create payroll checks for employees or independent contractors. These tools allow users to enter essential payroll details such as employee names, earnings, deductions, and company information, generating a professional-looking paycheck.

While some payroll check generators come as part of paid payroll software, many free versions are available, helping small businesses and freelancers issue payments efficiently.

Are Payroll Check Generators Legal?

Yes, using a payroll check generator is completely legal as long as it is used correctly and ethically. However, there are certain guidelines and best practices that businesses must follow to ensure compliance with employment and tax laws.

1. Accuracy Is Essential

- Any payroll check must reflect the accurate earnings, deductions, and net pay of an employee or contractor.

- Businesses must ensure that taxes and withholdings are calculated correctly.

- Falsifying paychecks or fabricating financial information is illegal and can lead to legal consequences.

2. Compliance With Tax Laws

- Payroll checks must include correct tax withholdings, such as federal and state income taxes, Social Security, and Medicare contributions.

- Employers are responsible for reporting wages and paying the necessary employer taxes to the IRS and state tax agencies.

- Failure to withhold or report taxes correctly can result in penalties or audits.

3. Proper Documentation and Record-Keeping

- Employers must maintain payroll records for a certain number of years, as required by federal and state labor laws.

- Employees and contractors should receive proper documentation of their earnings, such as paystubs and tax forms (e.g., W-2s and 1099s).

Legal Risks of Misusing Payroll Check Generators

Using a payroll check generator incorrectly or fraudulently can lead to legal problems. Here are some risks to be aware of:

1. Fake Paycheck Stubs for Fraudulent Activities

- Creating false paycheck stubs for loan applications, rental agreements, or other financial transactions is illegal.

- Banks and lenders verify income sources, and submitting false documentation can lead to charges of fraud.

2. Avoiding Payroll Taxes

- Businesses must report wages to the IRS and withhold proper taxes.

- Using a payroll check generator to create checks without reporting income is tax evasion, which is a federal offense.

3. Labor Law Violations

- Employers must ensure fair wages, overtime pay, and proper compensation in compliance with labor laws.

- If payroll check generators are used to underreport wages or misclassify employees, businesses may face lawsuits or fines.

How to Use a Payroll Check Generator Legally

To ensure compliance and avoid legal risks, follow these best practices:

1. Use a Reputable Payroll Check Generator

Choose a payroll check generator that provides accurate calculations and follows labor law requirements. Some trusted options include:

- Shopify’s Payroll Check Generator

- 123PayStubs

- ThePayStubs.com

- PaycheckCity

2. Verify Payroll Information

Before generating payroll checks, double-check all details:

- Ensure employee names, wages, and deductions are accurate.

- Include all applicable taxes and contributions.

- Keep records for tax reporting and compliance.

3. Report Payroll Taxes to the IRS

- Employers must submit payroll tax payments and reports regularly.

- Use forms such as W-2 (for employees) and 1099 (for contractors) to report wages.

- Stay up to date with tax laws and employment regulations.

4. Provide Employees With Proper Paystubs

- Paystubs should include gross earnings, deductions, and net pay.

- Some states legally require employers to provide detailed paystubs to employees.

Common Questions About Payroll Check Generators

1. Can I create paychecks for independent contractors using a payroll check generator?

Yes, payroll check generators can be used to pay independent contractors, but businesses must ensure that contractors receive a 1099 form for tax reporting.

2. Do I need payroll software if I use a payroll check generator?

A payroll check generator is a great tool for small businesses, but for larger businesses with many employees, full payroll software may be more efficient.

3. Is a payroll check generator the same as payroll software?

No, a payroll check generator helps create individual payroll checks, while full payroll software handles tax filing, direct deposit, and compliance features.

4. Are free payroll check generators safe to use?

Yes, but businesses should use trusted platforms with secure data processing to protect financial information.

Final Thoughts

A payroll check generator is a valuable tool for small businesses, freelancers, and self-employed professionals who need a simple way to generate payroll checks. As long as businesses use these tools correctly, maintain accurate payroll records, and comply with tax laws, they are completely legal to use.

By choosing a reliable payroll check generator, verifying payroll details, and fulfilling tax responsibilities, businesses can ensure they operate legally and efficiently. Whether you’re an employer or a contractor, using these tools responsibly will help streamline payroll management while staying compliant with labor and tax regulations.