In today’s fast-paced world, technology has transformed almost every aspect of our lives, including how we get paid. For decades, businesses have relied on traditional payroll systems to pay their employees. While these systems were once the standard, they’ve become increasingly outdated, cumbersome, and inefficient. Enter Paycheck Creator, an innovative solution that is reshaping the way companies handle payroll.

If you’re a business owner, HR manager, or someone involved in payroll management, this shift towards paycheck creators is something you should be aware of. It’s not just a trend; it’s a fundamental change in how we process wages, reduce errors, and save time. In this blog, we’ll take a deep dive into why traditional payroll is becoming obsolete and how paycheck creators are paving the way for a more streamlined, accurate, and efficient payroll process.

The Flaws of Traditional Payroll

Before we dive into the future of payroll, let’s look at the issues plaguing traditional payroll systems. Over the years, businesses have relied on methods such as paper checks, manual calculations, and spreadsheets to handle payroll. While these methods worked in the past, they now present several challenges:

1. Time-Consuming and Inefficient

Traditional payroll systems are notorious for being time-consuming. Payroll administrators often spend hours calculating employee hours, deductions, and benefits, especially when dealing with a large workforce. When paychecks need to be manually processed, the likelihood of mistakes increases, and that means more time spent correcting errors.

2. Human Error

Mistakes in traditional payroll systems can be costly. Simple errors in math or incorrect deductions can lead to underpayment or overpayment, causing confusion and dissatisfaction among employees. Correcting such mistakes not only takes time but also erodes trust between employers and employees.

3. High Costs

Payroll services and software can be expensive, especially for small businesses. Traditional payroll processing often requires outsourcing to payroll companies, which can charge hefty fees. In addition to this, the time spent managing payroll internally or through third parties comes at a cost, diverting resources from other important tasks.

4. Lack of Transparency

Traditional payroll systems are often opaque, leaving employees in the dark about how their wages and deductions are calculated. Without clear communication, employees can feel uncertain about the accuracy of their paychecks, leading to confusion and mistrust.

5. Compliance Challenges

With constantly changing tax laws and regulations, maintaining compliance with federal, state, and local tax rules can be a nightmare. Traditional payroll systems require manual updates, and a small oversight can lead to costly penalties.

The Rise of Paycheck Creators

Enter paycheck creators, a digital solution that automates payroll processing and addresses all the challenges associated with traditional methods. These modern tools allow employers to generate paychecks in just a few clicks, streamlining the entire process. But what makes paycheck creators stand out? Let’s explore the key benefits of paycheck creators and how they’re transforming the payroll landscape.

1. Simplicity and Automation

The biggest advantage of paycheck creators is their ability to automate the entire payroll process. By simply entering employee information and hours worked, these tools can calculate wages, deductions, taxes, and benefits automatically. There’s no need for manual data entry, reducing the risk of human error and saving time. Payroll administrators can process paychecks in minutes, not hours.

2. Accuracy

Paycheck creators are designed to minimize errors. By using automated calculations, the software ensures that all wages and deductions are accurate. This greatly reduces the risk of costly mistakes, such as underpayments or overpayments, that could arise from manual calculations. Automated systems are also updated regularly to comply with the latest tax regulations, ensuring that businesses remain compliant.

3. Cost-Effectiveness

For small to medium-sized businesses, paycheck creators offer a significant reduction in payroll costs. Unlike traditional payroll systems, which may require expensive software, third-party payroll providers, or dedicated payroll staff, paycheck creators can be affordable and efficient. Many paycheck creation tools operate on a subscription basis, allowing businesses to scale their costs based on the number of employees. This flexibility is ideal for startups and growing companies.

4. Time-Saving

The time savings associated with paycheck creators are substantial. Payroll administrators no longer need to manually input hours or calculate deductions. Once employee data is entered, the system takes care of the rest. This frees up valuable time for HR teams and business owners, allowing them to focus on more strategic tasks.

5. Transparency and Employee Access

Modern paycheck creators often come with features that allow employees to view their pay stubs and payment history online. This transparency builds trust and reduces the number of questions employees may have regarding their paychecks. Employees can easily access their pay information from anywhere, ensuring they’re always up to date.

6. Compliance Made Easy

Paycheck creators automatically update to reflect the latest tax rates and government regulations. This means businesses don’t have to worry about manually adjusting deductions or ensuring compliance with changing tax laws. Whether it’s federal, state, or local taxes, paycheck creators take care of it all, ensuring businesses avoid penalties and fines due to non-compliance.

Key Features of Paycheck Creators

Paycheck creators aren’t just about automating payroll; they come with a variety of features that make them incredibly user-friendly and versatile. Let’s take a closer look at some of the standout features:

1. Customizable Pay Stubs

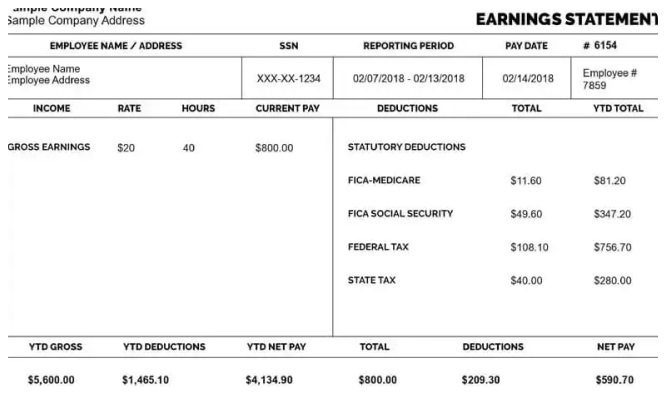

Paycheck creators allow employers to generate customizable pay stubs that include detailed information such as hours worked, hourly rate, taxes, deductions, bonuses, and more. This level of detail ensures that employees understand how their pay is calculated.

2. Direct Deposit Integration

Many paycheck creator tools integrate with direct deposit systems, allowing businesses to pay employees electronically. This not only speeds up the payment process but also eliminates the need for paper checks, reducing costs associated with printing and distributing paychecks.

3. Cloud-Based Access

Most paycheck creators are cloud-based, meaning business owners and HR teams can access them from any device with an internet connection. This is especially useful for businesses with remote employees or multiple locations.

4. Employee Self-Service

Many paycheck creators come with self-service portals where employees can access their pay history, download pay stubs, and update personal information. This self-service feature reduces the workload for HR departments and empowers employees to manage their pay information.

5. Tax Filing and Reporting

Some paycheck creators offer built-in tax filing capabilities, allowing businesses to file taxes directly through the software. This feature reduces the administrative burden and helps ensure that all tax filings are accurate and on time.

How Paycheck Creators Benefit Employers

For employers, the advantages of paycheck creators go beyond saving time and money. Here are a few additional benefits for business owners:

1. Scalability

As businesses grow, so do their payroll needs. Paycheck creators are scalable, meaning that as you add more employees, the system can easily handle the increased workload. There’s no need to hire more payroll staff or upgrade to more expensive payroll software.

2. Data Security

Data security is a top concern for businesses, especially when handling sensitive employee information. Paycheck creators prioritize data security by using encryption and other advanced security measures to protect your payroll data from unauthorized access.

3. Faster Payroll Cycles

With traditional payroll, the process can take days or even weeks to complete, especially when it involves manual calculations or third-party providers. Paycheck creators speed up the process, allowing businesses to run payroll in a matter of hours, or even minutes.

Conclusion

The traditional payroll system is no longer a one-size-fits-all solution in today’s fast-moving world. From time-consuming manual calculations to compliance headaches, traditional payroll systems are burdened with inefficiencies and errors. Paycheck creators, on the other hand, offer a modern, efficient, and cost-effective alternative.

For businesses looking to streamline their payroll processes, reduce costs, and improve accuracy, paycheck creators are the clear choice. These tools are not just the future of payroll; they’re the present, offering employers and employees a more transparent, efficient, and secure way to handle paychecks.

In conclusion, if you’re still relying on outdated payroll systems, it’s time to embrace the future. The switch to paycheck creators can help you stay competitive, compliant, and efficient in the ever-changing business world. Don’t wait – make the shift today, and experience the many benefits for your business and your employees.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs

Why is Intuit Paystub Perfect for Payroll Management? 5 Key Reasons