Managing payroll can be a headache for small business owners, freelancers, and independent contractors. Whether you’re handling payroll for a growing team or just keeping track of your own earnings, it’s crucial to ensure everything is accurate. A small mistake in payroll can lead to expensive consequences, including fines, taxes issues, and unhappy employees.

That’s where paystub creator come into play. These tools simplify the process, ensuring that you stay compliant, organized, and free from payroll errors. But what exactly is a paystub creator, and how can it help you avoid costly mistakes? Let’s dive in.

What is a Paystub Creator?

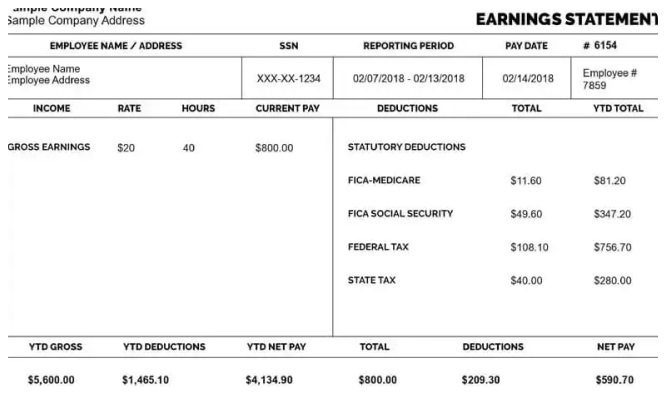

A paystub creator is a tool, either software or online application, that helps employers generate pay stubs for their employees or freelancers. Pay stubs are important documents that outline an individual’s earnings, tax withholdings, deductions, and other relevant information for a specific pay period. In the past, creating pay stubs involved manual calculations and paperwork, which left room for errors. Paystub creators automate the process, allowing users to generate accurate pay stubs in just a few minutes.

The Importance of Accurate Paystubs

Before we explore how paystub creators can prevent payroll mistakes, let’s understand why accurate paystubs are so critical. Paystubs are not just paperwork; they play a key role in ensuring transparency and compliance:

- Legal Compliance: In the U.S., businesses must provide employees with pay stubs as part of the Fair Labor Standards Act (FLSA). Failure to do so can result in penalties and legal consequences. Paystub creators ensure that your pay stubs meet legal requirements.

- Tax Filing and Reporting: Accurate pay stubs provide essential information for tax reporting. They show an employee’s gross wages, tax withholdings, and deductions, which makes the tax filing process smoother for both employers and employees.

- Employee Trust and Transparency: When employees receive clear, detailed pay stubs, it fosters trust and transparency. They can easily see how their salary is broken down, ensuring that there are no mistakes or misunderstandings regarding their compensation.

- Financial Planning: Paystubs offer employees a record of their earnings, deductions, and withholdings, which is vital for budgeting and financial planning. Without accurate paystubs, employees may face difficulties managing their finances.

Now that we know why paystubs are so important, let’s explore the ways a paystub creator can help you avoid costly payroll mistakes.

How Paystub Creators Help You Avoid Payroll Mistakes

1. Accurate Tax Calculations

One of the most common payroll mistakes is incorrect tax withholding. If an employee’s tax rate is miscalculated, it can lead to overpayment or underpayment of taxes. Either way, this could result in penalties from the IRS and confusion for employees when it comes time to file their annual taxes.

A paystub creator simplifies this by automatically calculating federal, state, and local tax deductions based on the employee’s tax bracket and filing status. This ensures that the right amount is deducted each pay period, reducing the risk of tax-related mistakes.

Example: Let’s say you’re running a small business in California, and one of your employees recently updated their W-4 form to reflect a change in their filing status. A paystub creator will automatically adjust the employee’s tax deductions based on this change. This helps avoid costly mistakes that might occur if you were calculating these deductions manually.

2. Clear Breakdown of Deductions

Deductions can be complex, especially if an employee has multiple types of deductions, such as retirement contributions, health insurance premiums, or union fees. Miscalculating or overlooking any of these deductions can lead to payroll errors.

A paystub creator gives you a clear breakdown of each deduction, making it easy to track how much is being taken from each paycheck and why. Whether it’s a federal withholding, social security contribution, or a voluntary deduction like a 401(k) contribution, everything is listed in detail on the paystub.

Example: If you have an employee enrolled in a company-sponsored health plan, the paystub creator will show the exact amount deducted for their premiums, so there’s no confusion about what’s being taken from their paycheck.

3. Minimizing Manual Errors

Manual payroll calculations are prone to human error. Whether you’re adding up hours worked, calculating overtime, or figuring out tax deductions, it’s easy to make mistakes. One wrong number can lead to an incorrect pay amount, creating issues for both the employer and the employee.

Paystub creators eliminate these manual errors by automating all calculations. With the right inputs, such as the number of hours worked and the applicable tax rates, the system ensures that the correct pay amount is generated every time.

Example: If your employee works overtime and earns 1.5 times their regular hourly rate, the paystub creator will calculate this overtime automatically based on the hours worked and the appropriate rate. You won’t have to worry about missing the extra pay or miscalculating it.

4. Easily Generating and Distributing Paystubs

Creating pay stubs manually can be time-consuming, especially if you have multiple employees or need to generate pay stubs for every pay period. A paystub creator allows you to quickly generate and distribute pay stubs in bulk, saving you valuable time and effort.

In addition, many paystub creators offer electronic delivery options, which means you can send pay stubs to your employees via email or an online portal. This ensures that pay stubs are delivered on time and that employees always have access to their payment history.

Example: If you’re running a business with a remote team, using a paystub creator allows you to generate pay stubs for all employees in one go and send them digitally, ensuring no delays and improving overall payroll efficiency.

5. Track and Archive Payment Records

Another benefit of using a paystub creator is that it allows you to track and store pay records easily. This is essential for both payroll audits and future reference. Having a digital archive of pay stubs ensures that you’re prepared in case of an audit, tax inquiry, or dispute with an employee about their pay.

Example: If the IRS requests information about an employee’s earnings for the past year, you can simply log into the paystub creator and retrieve a digital copy of every pay stub for that employee. This simplifies the process and keeps you organized.

6. Customizable to Your Business Needs

Every business has different payroll requirements. Some businesses pay employees hourly, while others pay salaried wages. Some offer commissions, bonuses, or other incentives. A paystub creator can be customized to reflect the unique payroll structure of your business.

By entering specific details about your company and its payroll policies, the paystub creator ensures that all necessary information is included on the pay stub, such as base salary, bonuses, commissions, and any other unique compensation.

Example: If you run a sales team that earns commissions in addition to their base salary, a paystub creator will allow you to easily input the commission earned and include it in the pay stub for each employee.

7. Employee Self-Service

Many paystub creators offer features that allow employees to view and download their own pay stubs. This self-service option reduces administrative workload for employers and gives employees more control over their payment information.

Instead of constantly fielding questions about pay rates, deductions, or missing pay stubs, employees can access their records themselves through an online portal or app. This helps avoid misunderstandings or mistakes that might occur when trying to interpret paper-based pay stubs.

Conclusion

Managing payroll is no easy task. But with the help of a free paystub creator, you can streamline the entire process, minimize errors, and avoid costly mistakes. From accurate tax calculations to clear breakdowns of deductions and the ability to quickly generate and distribute pay stubs, these tools make payroll management easier and more efficient.

Whether you’re a small business owner, a freelancer, or a contractor, using a paystub creator can save you time, reduce your stress, and ensure that your payroll is always accurate and compliant. By investing in the right paystub creation software, you can focus more on growing your business and less on worrying about payroll mistakes.

So, if you haven’t already, consider implementing a paystub creator today. It’s an investment in accuracy, compliance, and employee satisfaction — all of which are essential to the success of your business.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What is an eStub and How Does It Simplify Payroll Management?