When it comes to managing your finances, staying organized is key. Whether you’re a freelancer, small business owner, or employee, keeping accurate financial records is essential for both personal and professional financial health. One powerful tool that has gained popularity for this purpose is a paystub creator. But what exactly is a paystub creator, and why should you consider using one? In this blog, we’ll explore the benefits of using a paystub creator for accurate financial record-keeping and how it can make your financial life easier and more organized.

What is a Paystub Creator?

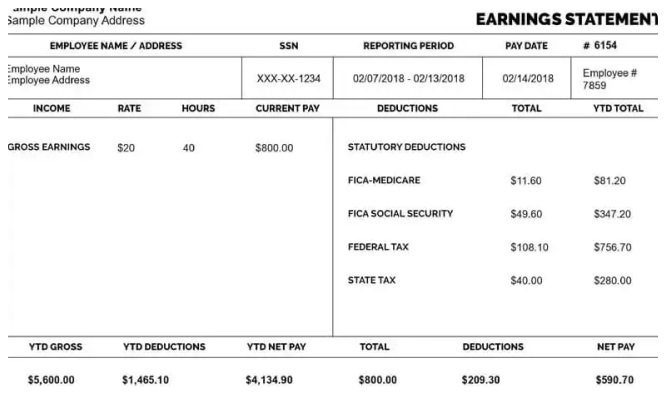

A paystub creator is an online tool or software designed to help you generate pay stubs for yourself or your employees. A pay stub is a document that outlines an employee’s earnings, deductions, and other financial details during a specific pay period. It acts as proof of income and provides a detailed breakdown of how much an individual earned, how much was deducted (e.g., for taxes, insurance, retirement plans), and the net amount they take home.

By using a paystub creator, you can easily create accurate and professional pay stubs for any pay period. These tools are often user-friendly, and customizable, and can save time compared to manual calculations or relying on accounting services.

Key Features of a Paystub Creator

Before diving into the benefits, let’s take a quick look at the main features you can expect from a paystub creator:

- Customizable Templates: Most paystub creators allow you to enter specific information such as the company name, employee details, hourly rates, overtime, tax deductions, and benefits. You can customize the format to suit your needs.

- Automated Calculations: A good paystub creator automatically calculates deductions like federal and state taxes, social security, medicare, insurance premiums, and retirement contributions, reducing the chances of error.

- Instant Download: After filling out the necessary details, you can instantly download and print the pay stub in a professional format. This is perfect for keeping both digital and physical records.

- Error-Free: Automated features and built-in checks help ensure your pay stub is accurate, which means fewer mistakes and a greater sense of confidence in your financial records.

- Secure Storage: Many paystub creators offer options for storing your pay stubs securely on their platform or allow you to back up documents to cloud storage for easy access in the future.

Benefits of Using a Paystub Creator

1. Accurate Financial Records

One of the most significant benefits of using a paystub creator is that it helps you maintain accurate financial records. For individuals and businesses alike, having accurate documentation is essential for budgeting, taxes, and securing loans. When you generate pay stubs using a creator, the tool automatically handles tax calculations, deductions, and other important details, ensuring everything is correct.

For employees, keeping accurate records of your earnings is vital when applying for loans, mortgages, or other financial assistance. For small business owners, it’s equally important to maintain precise pay records to comply with payroll regulations, monitor business expenses, and ensure tax compliance.

2. Saves Time and Effort

Manually calculating wages and deductions for employees can be tedious and prone to errors. A paystub creator free eliminates the need for manual calculations by automatically generating accurate pay stubs. This saves business owners valuable time and reduces the chances of mistakes.

For freelancers or independent contractors, using a paystub creator allows you to quickly document your income without needing to hire an accountant or create pay stubs from scratch. This helps you stay on top of your income records with minimal effort.

3. Helps with Tax Filing and Compliance

Both employees and employers are responsible for complying with federal and state tax regulations. A paystub creator can help simplify tax filing by providing detailed records of earnings and deductions throughout the year. For business owners, generating accurate pay stubs ensures that all tax calculations are correct, making it easier to file payroll taxes and avoid costly mistakes or penalties.

For employees, having a pay stub ready can simplify filing your annual tax returns. The pay stub provides a comprehensive summary of your total income, tax deductions, and withholdings, which you’ll need when filing your taxes.

4. Professional Appearance

A pay stub generated through a paystub creator is professionally formatted and looks much more official than handwritten or manually created pay stubs. This is especially important if you are running a business and providing pay stubs to employees. It gives a sense of professionalism and helps build trust with your workforce.

For individuals, a well-formatted pay stub can be essential when applying for loans, renting an apartment, or even when applying for financial aid. Financial institutions and landlords often prefer seeing official pay stubs that clearly outline your income and deductions.

5. Increased Transparency

A paystub creator promotes transparency between employees and employers. Employees can see the breakdown of their earnings, taxes, benefits, and any other deductions made from their paychecks. This transparency fosters a positive work environment and helps employees understand their pay better.

For business owners, offering transparency in pay stubs helps avoid misunderstandings regarding wages and deductions, ultimately leading to fewer disputes.

6. Reduces Human Error

Manual calculations and paperwork can result in errors, especially if done under time pressure. A paystub creator removes much of the manual work, reducing the chance of mistakes. Automated systems within these tools calculate deductions like tax withholding, social security, medicare, and insurance premiums based on the latest regulations, which are often updated within the software itself.

With a pay stub creator, you can be more confident that your records are accurate, reducing the risk of costly payroll errors.

7. Easy to Access and Share

Once you create a pay stub using an online paystub generator, you can access it anytime, anywhere, and easily share it with others. If you need to submit proof of income for a loan or rental application, you can quickly email or print out the pay stub. This flexibility makes it convenient for both employers and employees to manage their financial documents.

8. Streamlined Record-Keeping

For small business owners, staying organized is crucial. By using a pay stub creator, you can quickly create and store pay stubs for all employees. This allows for better financial tracking and easier audits. Having an organized system also means you can easily review past pay periods, track employee earnings, and ensure everything is for tax time.

9. Affordable Solution for Small Businesses

For small businesses with limited resources, hiring an accountant or payroll service to create pay stubs can be costly. A paystub creator is an affordable alternative that provides the same professional results without breaking the bank. You can generate pay stubs in minutes for a low cost, making it a cost-effective solution for businesses of all sizes.

10. Helps with Loan or Mortgage Applications

When applying for a loan or mortgage, lenders often require proof of income. Pay stubs are one of the most reliable forms of proof. Having a paystub creator at your disposal means you can generate these documents instantly, ensuring you always have an up-to-date and accurate record of your earnings to present to lenders.

How to Choose the Right Paystub Creator

When selecting a paystub creator, here are some factors to consider:

- Ease of Use: Look for a paystub creator that is simple to navigate, even for beginners. Most tools feature a straightforward interface with step-by-step instructions to guide you through the process.

- Customization Options: Ensure the creator allows for customization, including adding company details, employee information, and specific deductions.

- Security: Since pay stubs contain sensitive financial information, it’s important to choose a platform that offers encryption and secure document storage.

- Pricing: Compare pricing to ensure you’re getting good value. Many paystub creators offer tiered pricing based on the number of pay stubs or users.

- Customer Support: A good paystub creator should provide customer support in case you encounter any issues while using the tool.

Conclusion

Using a free paystub creator is an excellent way to ensure accurate financial record-keeping, whether you’re an employee, freelancer, or small business owner. It simplifies the process of generating pay stubs, saves time, reduces errors, and provides a professional and transparent way to manage earnings and deductions. By using an online paystub generator, you can stay organized, comply with tax regulations, and present your financial records in a clear, concise, and professional manner. Whether you’re managing payroll for employees or keeping track of your income, a paystub creator is a valuable tool that can help you streamline your financial management with ease.