When tax season rolls around, the most critical documents you typically rely on are your W-2 or 1099 forms. These forms summarize your annual earnings and the taxes withheld, serving as the foundation for filing your taxes. However, sometimes these forms may be delayed, incorrect, or even missing altogether. If you find yourself in this situation, you can still file your taxes using your paystubs as a temporary solution.

In this guide, we’ll explain how to file taxes with only paystubs, the steps you need to take to ensure accuracy, and how a free paystub generator can help freelancers, independent contractors, and small business owners track earnings and file taxes efficiently.

What Are Paystubs and Why They Matter for Tax Filing

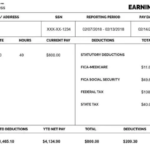

A paystub is a detailed document that outlines your earnings, taxes, and deductions for each pay period. While W-2s or 1099s offer a year-end summary, paystubs provide an ongoing record of your financial activity throughout the year. Paystubs include the following critical information:

- Gross Pay: Your total earnings before any deductions.

- Deductions: Federal, state, and local taxes, along with contributions to benefits like health insurance and retirement accounts.

- Net Pay: The amount you actually take home after deductions.

- Year-to-Date (YTD) Totals: Cumulative earnings, taxes, and deductions for the year up to that pay period.

Using your paystubs to file taxes ensures that you have accurate records of your income and withholdings, especially if you haven’t received official tax forms from your employer or clients.

Can You File Taxes with Only Paystubs?

Yes, you can file your taxes with just your paystubs, but this approach should ideally be a temporary solution. Paystubs provide all the necessary information about your earnings and tax withholdings, but they aren’t meant to replace official tax forms like a W-2 or 1099. If you haven’t received these forms by the IRS deadline (January 31), your paystubs can serve as an alternative source of information to file your taxes accurately and on time.

If you haven’t received your tax forms by mid-February, you should first contact your employer or client and request a copy. However, if you are unable to obtain the necessary forms in time, the IRS allows you to estimate your earnings and file using Form 4852 (Substitute for Form W-2 or 1099-R). Paystubs will be your primary source of information for this process.

Steps to File Taxes with Only Paystubs

1. Gather All Your Paystubs

The first step in filing taxes using only paystubs is to gather all the paystubs you’ve received during the tax year. This includes every paycheck from January 1 to December 31. Paystubs typically include a year-to-date (YTD) total, which helps you calculate your annual income and deductions.

- For Employees: If you’ve been working for the same employer all year, your final paystub of the year will provide a complete summary of your earnings and tax withholdings.

- For Freelancers/Contractors: If you’ve worked with multiple clients, you’ll need to collect paystubs or invoices from each client to calculate your total earnings and taxes paid.

2. Calculate Your Total Earnings

Using the year-to-date (YTD) totals on your final paystub, calculate your total earnings for the year. If you’ve switched jobs or had multiple employers, you’ll need to combine the earnings from each employer to get an accurate total.

- Gross Pay: This is the total amount you’ve earned before any deductions. It includes your regular wages, overtime, bonuses, and commissions.

- Net Pay: This is the amount you took home after all deductions. While it’s not necessary for filing your taxes, knowing your net pay helps with personal financial tracking.

3. Calculate Taxes Withheld

Your paystub will also show how much money has been withheld for federal, state, and local taxes, as well as contributions to Social Security and Medicare. Add up the year-to-date (YTD) totals for each category to calculate the total taxes withheld over the year.

- Federal Income Tax: Your paystub should show the total amount of federal tax withheld throughout the year.

- State and Local Taxes: If applicable, your paystub will also show state and local taxes withheld.

- Social Security and Medicare: These mandatory contributions are also listed on your paystub.

4. Fill Out IRS Form 4852 (Substitute for Form W-2)

If you haven’t received your W-2 by the time you need to file your taxes, you’ll need to use IRS Form 4852. This form serves as a substitute for a missing W-2 and allows you to estimate your earnings and tax withholdings based on your paystubs.

- Section I: Enter your personal information, such as your name, address, and Social Security number.

- Section II: Provide details about your employer, including their name, address, and Employer Identification Number (EIN), which you can find on your paystub or previous W-2 forms.

- Section III: This section asks for your total wages, tips, and other compensation. Use the year-to-date (YTD) totals from your final paystub to fill in these fields.

- Section IV: Enter the total federal income tax withheld, as shown on your paystub.

- Section V: If applicable, enter the total amount of state and local taxes withheld.

Once you’ve completed Form 4852, you can file your taxes as you normally would, either through a tax software program or by mailing in your tax return.

5. Double-Check for Accuracy

It’s crucial to double-check your calculations to ensure that the information you provide on your tax return is accurate. Mistakes in reporting your income or withholdings could result in underpayment or overpayment of taxes, leading to penalties or delays in processing your return.

- Cross-Check: If you’ve had more than one job or client, make sure you’re including income and taxes withheld from all sources.

- Estimate Conservatively: If you’re unsure of exact figures, it’s better to estimate conservatively to avoid underreporting your income.

6. Contact the IRS if Necessary

If you cannot get a W-2 or 1099 from your employer or client after reaching out, or if you believe your employer is not submitting your earnings information to the IRS, you can contact the IRS directly. The IRS will send a letter to your employer requesting the missing documents. In the meantime, you can file your taxes using Form 4852.

Using a Free Paystub Generator for Freelancers and Contractors

Freelancers, independent contractors, and small business owners may not receive traditional paystubs or tax forms like a W-2 or 1099 from their clients. In this case, using a free paystub generator can help you track your earnings and deductions throughout the year.

What Is a Free Paystub Generator?

A free paystub generator is an online tool that allows you to create customized paystubs by entering your earnings, taxes, and deductions. It helps freelancers and small business owners maintain accurate records of their income, making tax filing easier.

Benefits of Using a Free Paystub Generator

- Track Earnings and Deductions: Input your total earnings and taxes withheld to create detailed paystubs. This ensures you have an accurate record of your income when it’s time to file taxes.

- Professional Documentation: Paystubs generated using a paystub generator provide professional-looking proof of income, which can be used for tax purposes, loan applications, or rental agreements.

- Easy Access to Records: Keeping digital paystubs ensures that you always have access to your income and deductions, helping you stay organized and prepared for tax season.

- Customizable Options: A free paystub generator allows you to tailor your paystubs based on your specific needs, including adding tax withholdings, benefits deductions, and more.

How to Use a Free Paystub Generator

- Input Earnings: Enter your total earnings for the pay period or year. You can also input any additional income, such as tips, bonuses, or freelance work.

- Add Deductions: Include any taxes withheld, such as federal, state, and local taxes, along with deductions for Social Security and Medicare.

- Generate and Save: Once you’ve entered all the necessary information, the paystub generator will calculate your net pay and create a professional paystub. Download and save it for your records.

Conclusion

Filing taxes with only paystubs is possible, but it’s essential to ensure accuracy and provide all the necessary information to avoid potential errors or delays. Paystubs offer a detailed breakdown of your earnings, taxes, and deductions, making them a valuable resource when official tax forms like W-2s or 1099s are missing.

For freelancers, independent contractors, and small business owners, using a free paystub generator can help you create professional, accurate paystubs that make tax filing easier. By keeping track of your income and deductions throughout the year, you’ll be well-prepared for tax season, even if official tax documents are delayed or unavailable.

Remember to double-check all figures before filing and consult a tax professional if you’re unsure about any part of the process. Filing your taxes accurately and on time helps.